European mechanical plastics recycling exceeded 8 million tonnes in 2021 despite feedstock insecurities caused by Covid-19 slowdown

The waste plastics value chain is a complex and dynamic sector, with an evolving operating environment. New legislation and targets for the recycling of plastics and the use of recyclate are changing the way the whole plastics industry must operate. The mechanical plastics recycling industry, therefore, has become the focal point for investments, acquisition, and expansion.

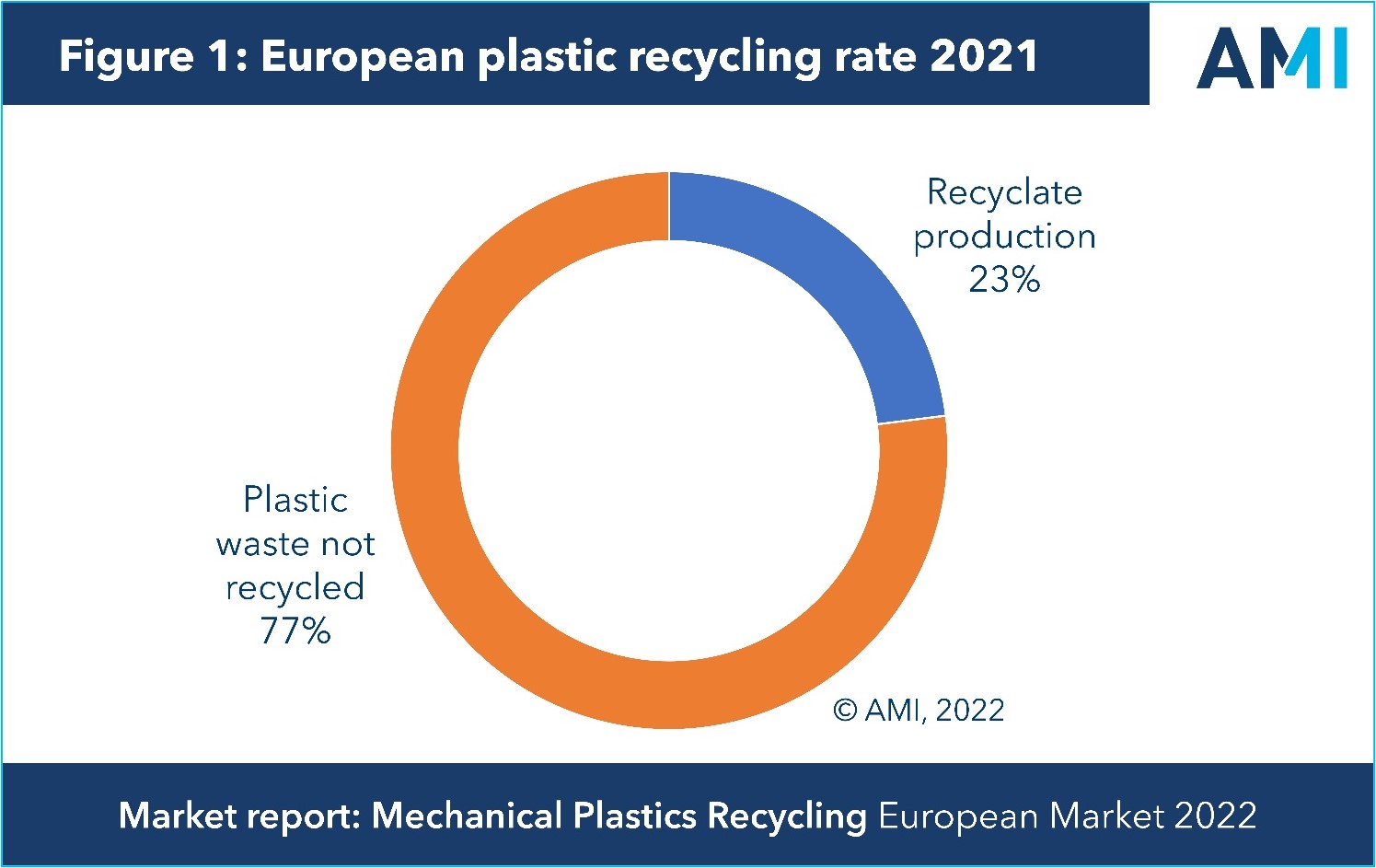

Although the volume of commodity plastic entering the waste stream on a yearly basis is extremely large, estimated by AMI as 35.6 million tonnes in 2021, feedstock availability should not be taken for granted. Much of this waste is currently uncollected for recycling or ‘lost’ at the sorting stage and ends up in landfill or used by EfW plants. Feedstock is therefore a finite resource, characterised by bail price fluctuations and variable quality and supply.

Plastics recyclate production was 8.2 million tonnes in 2021 and is forecast to grow at a rate of 5.6%/year to 2030. To put this figure into context, one must review it in tandem with the 35.6 million tonnes of commodity plastic entered the waste stream in 2021. This implies that Europe achieved an overall plastic recycling rate of 23.1%, far lower than one might have assumed.

The coronavirus pandemic has had an impact on both the volume of waste being collected for recycling as well as simultaneously reducing the demand for recyclate, as factories close or reduce production. However, to date it has not seemed to have had a long-lasting effect, as the industry has in general bounced back.

AMI sees within the 2030 timeframe of its report, additional absorption of recyclate volumes into applications that to date absorb negligible levels, particularly in Western Europe. Uses for recyclate are becoming more diverse, and the ability to absorb recyclate into higher value applications is also increasing, creating added value for the industry. AMI expects the commercialised and scaled production of food grade rPP and rPS within the timescale of the report, creating new closed loop systems, as we already see for rPET.

Expanding on its highly successful 1st edition, AMI’s brand new 2nd edition report, Mechanical Plastics Recycling 2022 quantifies the market for mechanical recycling, analysing the supply and demand balance, along with an evaluation of current production by country. The report also looks at feedstock supply and the waste plastics value chain. A detailed review of the end use applications for recyclate has been given, with an examination of potential future absorption.

The report, Mechanical Plastics Recycling – European Market 2022 is relevant to all those involved in the plastics industry value chain, from resin producer through to brand owners/end users of plastic products. The report delivers a comprehensive quantitative assessment of the current industry situation and forecasts where this critical aspect of the plastics industry will go in the future.